On September 24th, the Iranian government announced that it would adopt a three-tiered, multiple-exchange-rate regime. This wrong-headed attempt to exert more control over the price of domestic goods and combat inflation has failed (and will continue to fail). Since the rial began its free-fall in early September, international observers and the Iranian people have struggled to understand the implications of this exchange-rate regime.

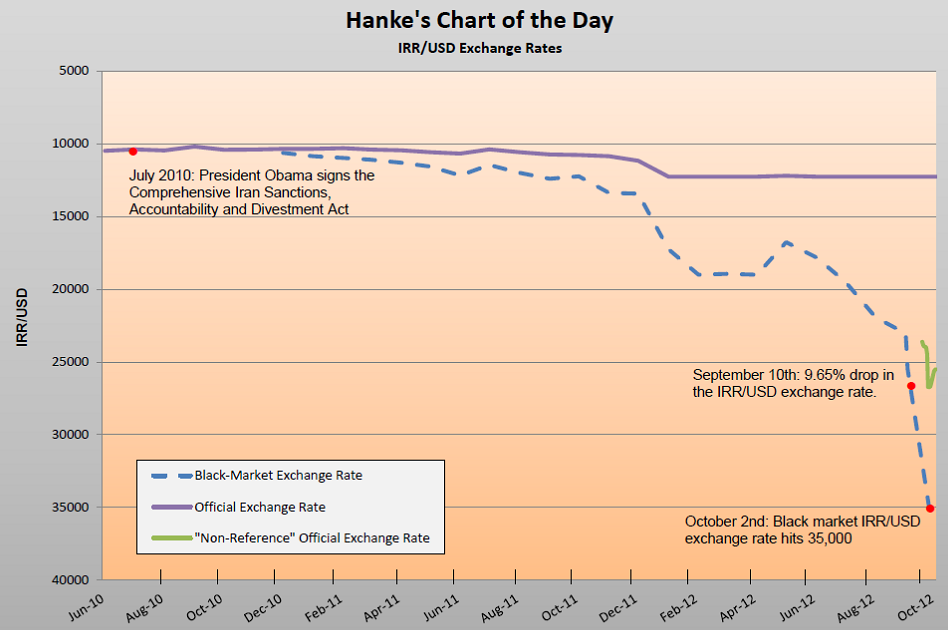

Iran has a history of implementing a variety of multiple-exchange-rate regimes – with mixed results, to say the least. Indeed, at its peak of currency confusion, the Iranian government set seven different official exchange rates. As the accompanying chart illustrates, the story of Iran’s hyperinflation has been one of divergence between the official and black-market (read: free-market) exchange rates.

This divergence is a product of the declining value of the rial – freely traded on the black market. In consequence, prices are rising dramatically in Iran – by almost 70% per month, according to my estimates. That said, in order to make sense of this phenomenon, it is necessary to understand the system whose failure we are witnessing.

Currently, Iran has three exchange rates:

- The Official Exchange Rate: 12,260 IRR/USD

- Available only to importers of essential goods, such as grain, sugar, and medicine

- The “Non-Reference” Rate: 25,480 IRR/USD

- Purportedly 2% lower than the black-market rate

- Available to importers of important, but non-essential goods, such as livestock, metals and minerals

- The Black-Market Exchange Rate: Approximately 35,000 IRR/USD

- The last freely-reported black-market rate was 35,000 IRR/USD (2 October 2012). The most recent anecdotal reports confirm this number as the current exchange rate.

- The Iranian government (read: police) has recently cracked down on currency traders and has also censored websites that report black-market IRR/USD exchange rates.

This complex currency system results in lying prices that distort economic activity. By offering different exchange rates for different types of imports, the Iranian government is, in effect, subsidizing certain goods – distorting their true price. In consequence, any fluctuations in the black-market exchange rate – and, accordingly, in the price level – will be amplified to different degrees for different goods. The end result for Iranian consumers is confusion and mistrust, which, as we have seen, are feeding the panic that has been driving the collapse of the rial and Iran’s hyperinflation.

Author Steve H. Hanke

0 responses on "Iran’s Lying Exchange Rates"