During the 1992 presidential campaign, former President Clinton’s rallying cry was “It’s the Economy, Stupid.” He sang it to perfection and won the election. Today, the smart politicians (and economists) should realize that “It’s the Money Supply, Stupid.” One doesn’t have to delve deeply into the mysteries of money to realize that money matters. But, you wouldn’t know it from reading the deluge of polemics on whether a fiscal stimulus is, or is not, the proper prescription for most of the world’s economies. Most of the doctors are misdiagnosing the real cause of the world’s economic ills because they often fail to take the patients’ monetary pulse. It’s as if the diagnosticians were unaware of the connection between money growth rates and economic health.

This wasn’t always the case. In the late summer of 1979, when Paul Volcker took the reins of the Federal Reserve System, the state of the U.S. economy’s health was “bad.” Indeed, 1979 ended with a double-digit inflation rate of 13.3%.

Chairman Volcker realized that money matters, and it didn’t take him long to make his move. On Saturday, 6 October 1979, he stunned the world with an unanticipated announcement. He proclaimed that he was going to put measures of the money supply on the Fed’s dashboard. For him, it was obvious that, to restore the U.S. economy to good health, inflation would have to be wrung out of the economy. And to kill inflation, the money supply would have to be controlled.

Chairman Volcker achieved his goal.

By 1982, the annual rate of inflation had dropped to 3.8% — a great accomplishment. The problem was that the Volcker inflation squeeze brought with it a relatively short recession (less than a year) that started in January 1980, and another, more severe slump that began shortly thereafter and ended in November 1982.

Chairman Volcker’s problem was that the monetary speedometer installed on his dashboard was defective. Each measure of the money supply (M1, M2, M3 and so forth) was shown on a separate gauge, with the various measures being calculated by a simple summation of their components. The components of each measure were given the same weight, implying that all of the components possessed the same degree of moneyness — usefulness in immediate transactions where money is exchanged between buyer and seller.

As shown in the accompanying chart, the Fed thought that the double-digit fed funds rates it was serving up were allowing it to tap on the money-supply brakes with just the right amount of pressure. In fact, if the money supply had been measured correctly by a Divisia metric, Chairman Volcker would have realized that the Fed was slamming on the brakes from 1978 until early 1982. The Fed was imposing a monetary policy that was much tighter than it thought.

Why is the Divisia metric the superior money supply measure, and why did it diverge so sharply from the Fed’s conventional measure (M2)? Money takes the form of various types of financial assets that are used for transaction purposes and as a store of value. Money created by a monetary authority (notes, coins, and banks’ deposits at the monetary authority) represents the underlying monetary base of an economy. This monetary base, or high-powered money, is imbued with the most moneyness of the various types of financial assets that are called money. The monetary base is ready to use in transactions in which goods and services are exchanged for “money.”

In addition to the assets that make up base money, there are many others that possess varying degrees of moneyness — a characteristic which can be measured by the ease of and the opportunity costs associated with exchangingthem for base money. These other assets are, in varying degrees, substitutes for money. That is why they should not receive the same weights when they are summed to obtain a broad money supply measure. Instead, those assets that are the closest substitutes for base money should receive higher weights than those that possess a lower degree of moneyness.

Now, let’s come back to the huge divergences between the standard simple-sum measures of M2 that Chairman Volcker was observing and the true Divisia M2 measure. As the Fed pushed the fed funds rate up, the opportunity cost of holding cash increased. In consequence, retail money market funds and time deposits, for example, became relatively more attractive and received a lower weight when measured by a Divisia metric. Faced with a higher interest rate, people had a much stronger incentive to avoid “large” cash and checking account balances. As the fed funds rate went up, the divergence between the simple-sum and Divisia M2 measures became greater and greater.

When available, Divisia measures are the “best” measures of the money supply. But, how many classes of financial assets that possess moneyness should be added together to determine the money “supply”? This is a case in which the phrase “the more the merrier” applies. When it comes to money, the broadest measure is the “best”. In the U.S., we are fortunate to have Divisia M4 available from the Center for Financial Stability in New York. The accompanying pie chart shows that the public money produced by the Fed (M0 base money) makes up only 15% of the total broad money (M4). A whopping 85% of the money in the U.S. is produced by the private banking system.

Since August 2008, the month before Lehman Brothers collapsed, the supply of publicly-produced base money has more than tripled, while privately-produced money shrunk by 12.5% — resulting in a decline in the total money supply (M4) of almost 2%. In consequence, the share of the total broad money supply accounted for by the Fed has jumped from 5% in August 2008 to 15% today.

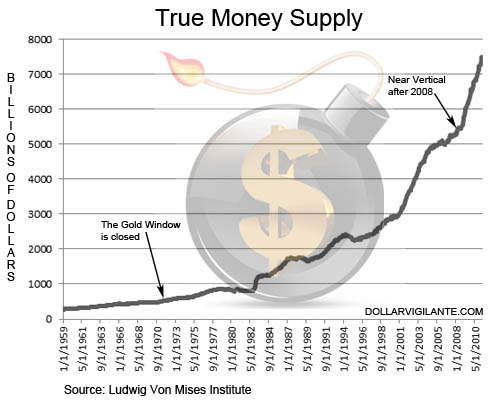

The disturbing course that has been taken by the money supply in the U.S. shows why we had a bubble, and why the U.S. is mired in a growth recession, at best (see the accompanying chart). If Fed Chairman Ben Bernanke had a money supply indicator — any money supply indicator — on his dashboard, he would, well, see reality. Money matters.

It is clear that while Fed-produced money has exploded, privately-produced money has imploded. The net result is a level of broad money that is way below where it would have been if broad money would have followed a trend rate of growth. The post-crisis monetary policy mix has brought about a massive opening of the public money-supply spigots, and a significant tightening of those in the private sector. Since the private portion of the broad money supply in the U.S. is now five and a half times larger than the public portion, the result has been a decrease in the money supply since the Lehman Brothers collapse. So, when it comes to money in the U.S., policy has been, on balance, contractionary — not expansionary. This is bad news, since monetary policy dominates fiscal policy.

Wrongheaded public policies have put the kibosh on banks and so-called shadow banks, which are the primary private money-supply engines. They have done this via new and prospective bank regulations flowing from the Dodd-Frank legislation, new (more stringent) Basel III capital and liquidity requirements, and uncertainty as to what Washington might do next. All this has resulted in financial repression — a credit crunch. No wonder we are having trouble waking up from this nightmare.

The picture for the Eurozone, absent Germany, looks very similar to that of the U.S., while the German picture looks rather healthy (see the two accompanying charts containing standard M3 money supply measures). Indeed, Germany’s money supply is above where it would have been if it was growing at a trend rate. This peculiarity is occurring, in part, because hot money is taking flight from places like Greece and Spain and flowing into Germany. This pumps up the German money supply. It’s no surprise, therefore, that the German economy is a picture of health relative to the rest of Europe. It’s also no surprise that the United Kingdom has taken a double-dip recession (see the accompanying U.K. chart for M4).

This brings us back to Germany and the Eurosystem’s doom loop. It’s clear that the sick ones are pleading for an assist from the largest and healthiest one, Germany. The sick ones, in accounting parlance, want to book a contra-liability. That’s the type of entry that’s booked when the responsibility for servicing a debt is foisted off on a third party — like Germany.

This, of course, is creating a great deal of angst among the Germans because there is a lot of money involved. Today, the German taxpayers’ exposure to the weaker countries represents at least one quarter of Germany’s GDP, and it’s rising. Facing a bill like that, German Chancellor Angela Merkel has recently pushed back and stated the obvious: “Germany’s strength is not infinite.” What can be done? For a start, new, excessive bank regulations should be scaled back, or scrapped altogether — particularly when we’re in the middle of the worst slump since the Great Depression. Basel III’s stringent capital-asset ratios and liquidity coverage ratios are prime candidates. Such a roll-back would alleviate financial repression, allowing the banking system to increase the privately-produced portion of the broad money supply. Since excessive and untimely regulation is what’s holding down broad money growth, this is just what the doctor ordered. Remember, it’s the money supply, stupid.

References:

William A. Barnett. Getting It Wrong: How Faulty Monetary Statistics Undermine the Fed, the Financial System, and the Economy. Cambridge, MA: MIT, 2012.

Tim Congdon. Money in a Free Society: Keynes, Friedman, and the New Crisis in Capitalism. New York: Encounter, 2011.

Tim Congdon. On Broad Money vs. Narrow Money. London: Lombard Street Research, 2005.

Edward J. Kane. “Who’s on the Hook for Europe’s Losses, and for How Much?” American Banker, 8 June 2012.

Allan H. Meltzer. A History of the Federal Reserve: Vol. II, Book Two, 1970-1986. Chicago: University of Chicago, 2003.

William L. Silber. Volcker: The Triumph of Persistence. New York: Bloomsbury, 2012.

Hans-Werner Sinn. “European End Game.” The International Economy, Winter 2012.

Author Steve H. Hanke

0 responses on "It’s the Money Supply, Stupid"