Since the U.S. and E.U. first enacted sanctions against Iran, in 2010, the value of the Iranian rial (IRR) has plummeted, imposing untold misery on the Iranian people. When a currency collapses, you can be certain that other economic metrics are moving in a negative direction, too. Indeed, using new data from Iran’s foreign-exchange black market, I estimate that Iran’s monthly inflation rate has reached 69.6%. With a monthly inflation rate this high (over 50%), Iran is undoubtedly experiencing hyperinflation.

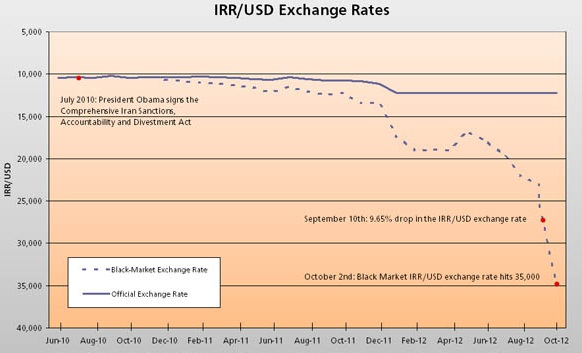

When President Obama signed the Comprehensive Iran Sanctions, Accountability, and Divestment Act, in July 2010, the official Iranian rial-U.S. dollar exchange rate was very close to the black-market rate. But, as the accompanying chart shows, the official and black-market rates have increasingly diverged since July 2010. This decline began to accelerate last month, when Iranians witnessed a dramatic 9.65% drop in the value of the rial, over the course of a single weekend (8-10 September 2012). The free-fall has continued since then. On 2 October 2012, the black-market exchange rate reached 35,000 IRR/USD – a rate which reflects a 65% decline in the rial, relative to the U.S. dollar.

The rial’s death spiral is wiping out the currency’s purchasing power. In consequence, Iran is now experiencing a devastating increase in prices – hyperinflation. As Nicholas Krus and I document in our recent Cato Working Paper, World Hyperinflations, there have been 57 documented cases of hyperinflation in history, the most recent of which was North Korea’s 2009-11 hyperinflation. That said, North Korea’s hyperinflation did not come close to the magnitudes reached in the recent, second-highest hyperinflation in the world, that of Zimbabwe, in 2008, nor has Iran’s hyperinflation – at least not yet.

Author Steve H. Hanke

0 responses on "Hyperinflation Has Arrived In Iran"