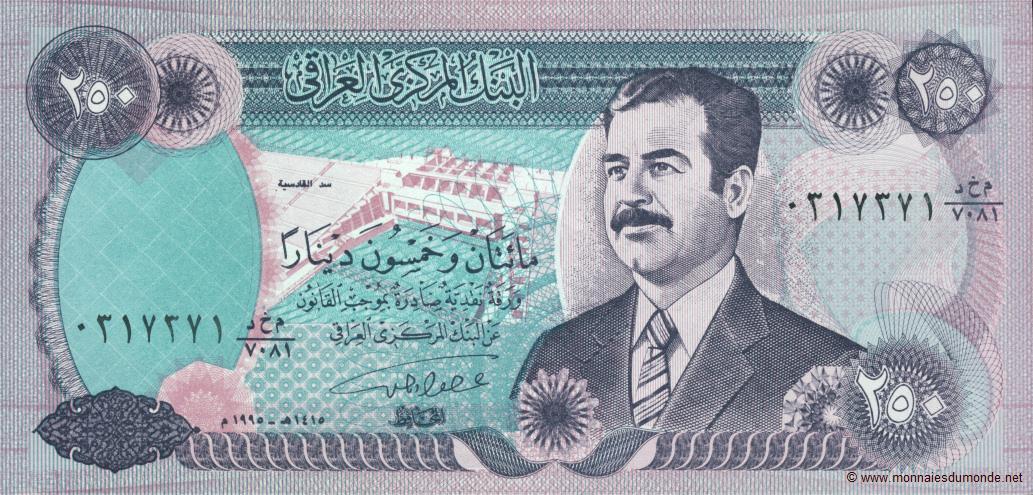

Millions of fresh dinars, graced with the visage of Saddam Hussein, recently began rolling off Iraq’s printing presses at the behest of the Coalition Provisional Authority. This inspired about as much confidence and unity as the Allies would have garnered with the introduction of Mussolini lire and Hitler marks after World War II.

To belatedly correct this maladroit decision, L. Paul Bremer, head of the provisional authority, announced on July 7 that new Iraqi dinars will be introduced over a three-month period starting in October. These will replace both the Saddam dinars and the “Swiss” dinars that circulate in Iraq’s Kurdish areas. And to reinforce its adeptness, the provisional authority has handed the banknote-printing contract (awarded without competitive bid, as it were) to a company with a subsidiary that, on July 9, became the subject of a price-fixing investigation by the Justice Department.

Mr. Bremer has now declared that an independent central bank will govern the emission of new dinars. This seems like an unattainable objective. We should not hold our collective breath anticipating a Bundesbank clone to be plopped down in Baghdad.

* * * What are the chances that an “independent” Iraqi central bank will be able to restore confidence and pursue the sole objective of price stability without government interference? Simply put, no central bank can be independent without a strong dose of fiscal control. After all, any budget deficit that cannot be financed in domestic or foreign debt markets will have to be financed by money creation. This is the inflation tax at work. If Iraq is going to resist the inflation tax (which is, incidentally, the easiest tax to collect when the legal and fiscal infrastructure is nonexistent or flimsy), the transitional administration needs to produce an iron-clad budget.

The prospects for such a budget are dim, however. On the revenue side, the administration plans to rely on oil revenues. Never mind the investments and repairs needed to activate the oil fields fully, as well as theft, smuggling and sabotage. Opportunities for spreading the tax base are few, as little productive activity survives, and resources are not in place to administer income or excise taxes. And there are so far no privatizations in the works.

On the expenditure side, the administration will need to confront a number of demons. Besides paying for reconstruction — no easy task — the transitional administration will have to unwind the institutions of a command economy. It will inherit bankrupt state-owned enterprises. The banking sector will have to be recapitalized and revamped to operate in a market economy. A decision must be made on whether outstanding debt from the Hussein regime will be serviced. And all of this is not to mention the growing wish list cobbled together by Washington, including massive health-care spending, investment in educational facilities, and the construction of that great open-ended contingency and hallmark of Western welfare states, the “social safety net.” The gap between potential revenues and planned expenditures will be large. The relatively large primary deficit in the interim budget is already scheduled to be financed by printing money.

Even if the fiscal management in Iraq is exemplary, the idea of an independent, Bundesbank-style Iraqi central bank is nearly laughable. Indeed, the language being used to describe the future operations of the central bank gives a false air of sophistication to what will be a primitive affair. Interventions in the foreign-exchange market will not take place at a Reuters terminal, but in the open outcry of the bazaar, where traders will have to be coerced in some way to buy and sell at the desired exchange rate. The interbank market — an indispensable institution for directing the course of interest rates and the availability of liquidity — will probably consist of several trucks plodding through the desert laden with banknotes and paperwork. Money markets — in which short-term paper is traded, and where central banks buy and sell bonds when conducting open market operations — will again be more like the bazaar than Lombard Street, if they exist at all. The Iraqi central bank can also forget about such modern conveniences as real-time gross settlement, indirect instruments of monetary policy, and any close supervision of the banking system.

In short, the transitional administration wants to erect some huge central-banking edifice, but no scaffolding is to be found. The British were at least competent enough to point out the legal and economic prerequisites of central banking when that idea first came to the region. Then, as now, those prerequisites are absent in Iraq. But the coalition authority hasn’t the slightest appreciation of the technical issues it’s blundered into.

A successful currency-reform plan must be well-crafted and informed by Iraq’s history. In the past, Iraq has had success with “dollarization” and a currency board. From 1916 to 1932, Iraq used the Indian rupee, which was linked to sterling, as its official currency. When Iraq became independent in 1932, the Iraq Currency Board was opened. It issued a convertible Iraqi dinar at par with the British pound, backing the dinar fully with pound reserves. Until the central bank commenced operations in 1949, the currency board operated without problems.

A currency reform for Iraq must not include a central bank, even one that is nominally independent. Iraq’s history suggests two alternatives would be superior to a central bank. It could return to a currency-board system governed by a foreign national. Ideally, legislation for an Iraqi currency board would follow the model of the classic British currency boards. Bosnia and Herzegovina’s currency board, which was mandated by the Dayton/Paris Treaty of 1995, is a close approximation of such an orthodox system. Indeed, the quick execution of the legislation for Bosnia’s currency board is a testament to the technical expertise of the Treasury under Robert Rubin and Lawrence Summers. The system inspired confidence, was a cohesive force in unifying a country ravaged by civil war and has produced sound money.

It could also “dollarize” by replacing the dinar with the euro (or the greenback). The euro has international acceptance, and neither the U.S. nor Britain uses it, which may be something of a political advantage in the current context. Several other countries have replaced their local currency with a foreign currency in the last few years, including Ecuador, El Salvador, and East Timor (which use the dollar), and Montenegro and Kosovo (which use the euro). No significant technical obstacles stand in the way of making the euro Iraq’s official currency. If the transitional administration is going to switch currencies, why not upgrade to one that’s worth using?

Author Steve H. Hanke

0 responses on "Dinar Plans"