Central banks issue currency and exercise wide discretion over the conduct of monetary policy. Although widespread today, central banks are relatively new institutional arrangements. In 1900, there were only 18 central banks in the world. By 1940, forty countries had them, and today there are 164.

Before the rise in central banking (monetary nationalism) the world was dominated by unified currency areas, or blocs, the largest of which was the sterling bloc. As early as 1937, the great Austrian economist Friedrich von Hayek warned that the central banking fad, if it continued, would lead to currency chaos and the spread of banking crises. His forebodings were justified. Currency and banking crises—while nowhere to be seen at present—have engulfed the international financial system with ever-increasing strength and frequency. Indeed, for most emerging-market countries with central banks, relatively free capital mobility has produced hot money flows and repeated exchange-rate and domestic banking crises. What to do?

The obvious answer is for vulnerable emerging-market countries to do away with their central banks and domestic currencies, replacing them with a sound foreign currency. Panama is a prime example of the benefits from employing this type of monetary system. Since 1904, it has used the US dollar as its official currency.

Panama’s dollarized economy is, therefore, officially part of the world’s largest currency bloc. To integrate its banking system into the world’s dollar-based financial markets, Panama changed its banking laws in 1970. As a result, international banks have been eager to take part in the offshore financial revolution. The growth of Panama’s banking system attests to the fact that the 1970 banking reforms allowed Panama to take advantage of the trends in globalization and free flow of capital. Panama’s dollarized monetary system eliminates its exchange rate risks and the possibility of a currency crisis vis-à-vis the US dollar. And the possibility of banking crises is largely mitigated because Panama’s banking system is integrated into the international financial system. The nature of Panamanian banks provides the key to understanding how the system as a whole functions smoothly. When these banks’ portfolios are in equilibrium, they are indifferent at the margin between deploying their liquidity (creating or withdrawing credit) in the do mestic or international markets. As the credit-creating potential in these banks changes, they evaluate the risk-adjusted rates of return in the domestic and international markets and adjust their portfolios accordingly. Excess liquidity is deployed domestically if domestic risk-adjusted returns exceed those in the international markets and internationally if the international risk-adjusted returns exceed those in the domestic market. This process is thrown into reverse when liquidity deficits arise.

The adjustment of banks’ portfolios is the mechanism that allows for a smooth flow of liquidity and credit into and out of the banking system and the economy. Excesses or deficits of liquidity in the system are rapidly eliminated because banks are indifferent as to whether they will deploy liquidity in the domestic or international markets. Panama is just a small pond connected by its banking system to a huge international ocean of liquidity. When risk-adjusted rates of return in Panama exceed those overseas, Panama draws from the international ocean of liquidity, and when the returns overseas exceed those in Panama, Panama adds liquidity (credit) to the ocean abroad. To continue the analogy, Panama’s banking system acts like the Panama Canal to keep the levels of two bodies of water in equilibrium. Not surprisingly with this high degree of financial integration, the levels of credit and deposits in Panama are uncorrelated.

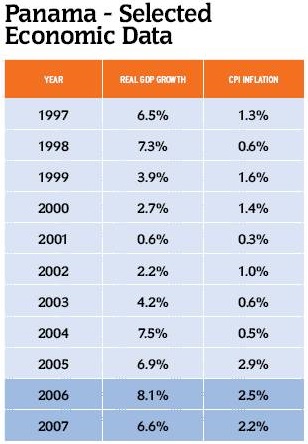

The results of Panama’s dollarized money system and internationally integrated banking system have been excellent when compared to other emerging market countries (see accompanying table).

Panama’s GDP growth rates have been relatively high and their volatility relatively low. This is rather remarkable when you consider that Panama is a classic dual economy. On the one hand, the services sector (banking) is export-oriented, capital intensive, highly productive, generates little employment and is largely free of government interference. On the other hand, the agricultural and manufacturing sectors are stagnant, highly regulated and subsidized, inefficient, labor intensive and uncompetitive.

- Interest rates have mirrored world market rates, adjusted for transaction costs and risk.

- Inflation rates have been somewhat lower than those in the US.

- Panama’s real exchange rate has been very stable and on a slightly depreciating trend vis-à-vis that of the US.

- Panama’s banking system, which operates without a central bank lender of last resort, has proven to be extremely resilient. Indeed, it weathered a major political crisis between Panama and the United States in 1988 and made a strong comeback by early 2000.

To insure against currency and banking crises, emergingmarket countries should follow Panama’s lead: forego monetary nationalism by dumping central banks and domestic currencies, and fully integrate their banking systems with international capital markets.

Author Steve H. Hanke

0 responses on "Fewer Central Banks, Please"