Until a few months ago, many Indonesians thought the subprime lending debacle in the United States would pass them by without a worry. Growth remained well above 6% through the second quarter of last year. The rupiah-U.S. dollar exchange rate had been steady for many months and international reserves were high and rising. The budget deficit was under control. Inflation, at roughly a 12% annual rate, was the only metric that generated much concern.

During the second half of last year, however, the picture turned dramatically darker. Stock prices fell sharply, with a huge drop on October 8—one that prompted the authorities to close the stock exchange for the rest of the week. The rupiah came under considerable pressure, and a privately owned bank was put under the direct supervision of the authorities. Now Indonesians are climbing the proverbial wall of worry.

The last time Jakarta faced these challenges was during the Asian financial crisis, when the rupiah lost over 80% of its value against the dollar in less than a year, GDP plummeted by 13% in 1998 and the banking system imploded. The bank bailout alone cost Indonesia’s taxpayers at least $50 billion—40% of GDP. If the government and the central bank repeat the same mistakes made back then, Indonesians could be in for another painful episode.

The signs aren’t all good. Take exchange rate policy. Notwithstanding having nominally floated the rupiah in 1997, the central bank has never overcome its aversion to fully floating exchange rates. Instead, Bank Indonesia has “managed” the float, intervening simultaneously in the foreign exchange market and the domestic money market. In essence, it has both exchange rate and monetary policy targets, and these often contradict each other.

Until late last year, Bank Indonesia purchased U.S. dollars continuously, preventing the rupiah from appreciating. In consequence, it accumulated an impressive war chest of international reserves. These purchases of foreign exchange could have been financed by printing more money. The resulting inflation would have triggered an inflation-adjusted, or real, rupiah appreciation, with the currency moving toward its fundamental, market based equilibrium. Instead, the central bank borrowed in rupiah by issuing certificates known as Sertifikat Bank Indonesia, or SBIs. While this technique limited inflationary money creation and real rupiah appreciation, it pushed domestic interest rates higher than they would have been otherwise.

Just as in 1997, this combination of policies had dramatic consequences for Bank Indonesia’s profitability, as there was a large negative spread between the return on its foreign assets and the cost of its domestic liabilities. This translated to an equally large positive spread available to domestic and foreign private sector investors. The easy profits to be made by borrowing cheaply in dollars and investing in high return rupiah securities was more than enough to offset any concern about the exchange-rate risk inherent in this so-called “long-rupiah carry trade.”

Paradoxically, the attempt to provide a war chest against balance of payments shocks had the perverse effect of heightening vulnerability to sudden, destabilizing capital outflows. When the current financial crisis hit, investors rushed to unwind their exposures. Sudden, heavy bouts of government bond selling occurred, with huge yield spikes in October and November last year.

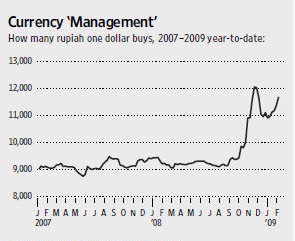

In recent months, the central bank has spent some $8 billion of its $60 billion in reserves to shore up the currency. This did not prevent the rupiah from depreciating by some 28% against the greenback last October and November, however. Frustrated by this outcome, Bank Indonesia imposed limited capital controls. Monthly foreign exchange purchases not connected to an underlying trade or debt repayment transaction are now limited to $100,000 per entity. Even with the imposition of these restrictions, the rupiah was still down by 25% against the U.S. dollar in the six months to the end of January.

In another policy response to the global financial crisis, Bank Indonesia indicated that it would reduce the issuance of SBIs. The government also signalled its intention to reduce its domestic borrowing. But it seems Bank Indonesia has not forgotten that its huge liquidity injections designed to rescue troubled banks in 1997-98 were followed by a rupiah collapse and a surge in inflation. Accordingly—and unlike most other central banks—Bank Indonesia initially decided to keep its policy interest rate steady, having increased it moderately earlier last year in response to an uncomfortably high inflation rate.

Of course, it is most difficult to increase liquidity and keep interest rates constant. Although Bank Indonesia reluctantly reduced its policy rate by 0.25 percentage points on December 4, 2008, and by a further 0.50 percentage points on both January 7 and February 4, these changes are to some degree meaningless, since this rate is not attached to any security actually traded in the market. The true interest rate policy stance is best indicated by market-determined yields on SBIs and government bonds. On February 4, one-month certificates were issued at 8.91%—above the new 8.25% policy rate—while the two year bond yielded 11%. This stance has allowed liquidity to increase quite rapidly—albeit at a slower rate than during the first three quarters of 2008.

Indonesia’s attempts to hold markets away from a fundamental equilibrium have left the country more vulnerable than need be. Indeed, it was this kind of unsustainable exchange- rate regime that contributed to Indonesia’s plunge into chaos and the abrupt end to the 32-year Suharto era in 1998.

As the July presidential election approaches, President Susilo Bambang Yudhoyono needs to be mindful of the lessons of the past. It’s time for the central bank to back away from market interventions that engender distortions such as exchange controls and increase Indonesia’s vulnerability to destabilizing capital flows. Indonesia should either let the rupiah float freely and follow a rule-based monetary policy, or—even better—it should fix the rupiah’s exchange rate and allow monetary policy to be set on autopilot.

Author Ross H. McLeod and Steve H. Hanke

0 responses on "Indonesia’s Monetary Muddle"