Hungary is in a recession, again. According to the chattering classes, as well as many analysts and financial reporters, fiscal austerity is the cause of Hungary’s slump.

Nonsense. Hungary’s recession results from its slumping money supply.

When monetary and fiscal policies move in opposite directions, the economy will follow the direction taken by monetary (not fiscal) policy – money dominates. For doubters, just consider Japan and the United States in the 1990s. The Japanese government engaged in a massive fiscal stimulus program, while the Bank of Japan embraced a super-tight monetary policy. In consequence, Japan suffered under deflationary pressures and experienced a lost decade of economic growth.

In the U.S., the 1990s were marked by a strong boom. The Fed was accommodative and President Clinton was super-austere – the most tight-fisted president in the post-World War II era. President Clinton chopped 3.9 percentage points off federal government expenditures as a percent of GDP. No other modern U.S. President has even come close to Clinton’s record.

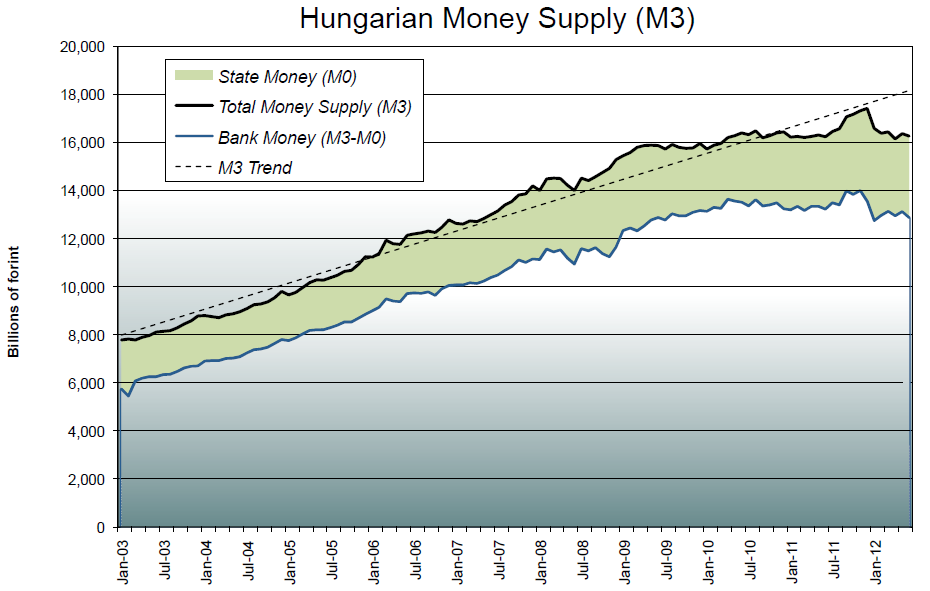

The money supply picture for Hungary seemed to be looking up until late 2011 (see the accompanying chart). Indeed, Hungary’s money supply had nearly returned to its trend-rate level, when it peaked in November 2011. Then, in the course of just over a month, things took a turn for the worse.

First, Moody’s downgraded Hungary’s debt to junk status, and soon thereafter, S&P and Fitch followed suit. Then, the EU and IMF walked out on debt restructuring talks, citing concerns over proposed constitutional changes, which threatened the Hungarian central bank’s independence. Just days later, their fears were confirmed, as the Hungarian Parliament passed the controversial law, merging the central bank with the Financial Supervisory Authority. And, to top it off, Hungary unexpectedly cancelled part of its December debt auction.

When the dust settled, confidence in Hungary’s financial system had been shattered. Despite a 15.9% increase in the supply of state money, the total money supply had plummeted by 4.2% (from November 2011 to January 2012). As the accompanying table shows, this decline in the total money supply was driven by a 9% drop in the all-important bank-money component of the total.

Hungary’s money supply has yet to recover from this perfect monetary storm. And, as if that wasn’t enough, Hungary recently adopted a damaging financial transactions levy.

Money and monetary policy trump fiscal policy. Until Hungary gets its money and banking houses in order, its economy will continue to wallow in recession.

Author Steve H. Hanke

0 responses on "Slumping Money Supply (Not Austerity) Plunges Hungary Into Recession"