The Swiss National Bank is conducting a bizarre, contradictory, and potentially dangerous set of monetary policies.

During the past year, the SNB has mandated the imposition of super-high bank capital requirements. Indeed, the SNB, in its annual Financial Stability Report, even admonished Credit Suisse for not building up a big enough capital cushion. The Swiss capital mandates have caused the rate of growth in money created by Swiss banks (bank money) to plunge.

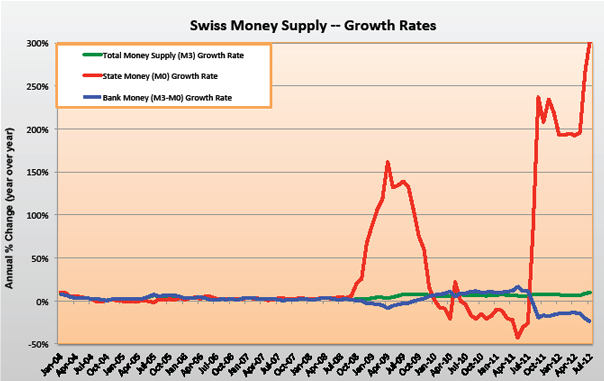

As can be seen in the accompanying chart, Swiss bank money was 25 percent lower in July 2012 than it was in July 2011. This should be alarming because bank money is, by far, the biggest component of the total money supply. In fact, since the beginning of 2003, bank money has, on average, constituted 89 percent of the total Swiss money supply.

Bank regulations in Switzerland and elsewhere, have resulted in, you guessed it: very tight bank money.

Not being one to sit on its hands, the SNB has turned on its money pumps. Indeed, Swiss state money—the money produced by the SNB—was 305 percent higher in July 2012 than in July 2011.

This explosion in state money has been more than enough to offset the contraction of the all-important bank money component.

In consequence, Switzerland’s total money supply grew at a 10 percent year-over-year rate in July 2012. With double-digit money supply growth, and overall prices declining, it’s little wonder that prices in certain asset classes, such as housing, are surging in Switzerland.

Author Steve H. Hanke

0 responses on "Swiss Monetary Policy: Dangerous Contradictions"