As everyone knows, food prices have ratcheted up dramatically in the past few years. The accompanying food price chart, which displays the Food and Agriculture Organization’s food price index of 55 commodities, presents the picture in stark terms.

Rice prices have contributed mightily to the ratchet – more than doubling since the beginning of the year. That said, the futures markets for rice, which are admittedly fragmented and thin, indicate that there are not acute rice shortages.

Given the recent food riots, the surge in the volume of news coverage about rice shortages and the political panic about rice policies – this news from the futures markets strikes a dissonant cord.

The economics of commodity markets provides the key to unlocking this mystery. The net cost of carrying inventories is equal to the interest rate, plus the cost of physical storage, minus the “convenience yield”.

The convenience yield is driven by the precautionary demand for the storage. When the convenience yield is zero, a market is in “full carry”, future prices exceed spot prices and inventories are abundant.

Alternatively, when the precautionary demand for a commodity is high, spot prices are strong and exceed future prices, and inventories are unusually low.

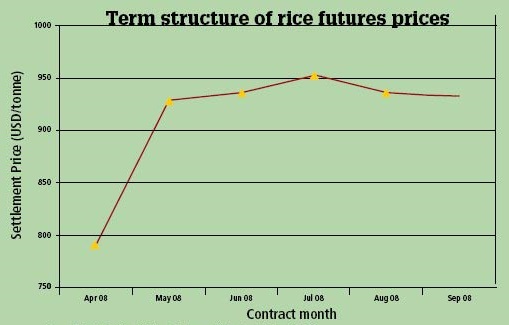

As the term structure of rice prices makes clear (see chart), the precautionary demand in Thailand is not elevated and inventories are ample. Indeed, for the term structure of prices to be signaling unusually low inventories, the term structure would be negative in slope, not positive.

In most countries, rice production and trade are subject to a plethora of laws and regulations. Subsidies to rice producers and consumers are widespread. Tariffs on imports and exports are common, as are import and export quotas.

Many of these policies derive from a food security rationale and the desire to keep a large proportion of rice production at home. In consequence, rice markets are segmented, with wide differences in rice prices (adjusted for rice quality and transport costs) among countries.

Not surprisingly, a relatively small proportion – only 6%-7% – of world production is exported.

To understand the distortions, inefficiencies and huge budget and economic costs associated with government meddling in Indonesia’s rice production and trade all one has to do is read the current issue of the prestigious Bulletin of Indonesia Economic Studies.

It is hot off the press. This special issue of the BIES is devoted to Indonesia’s rice policies.

A few of the findings in this dense volume give the flavor:

- The government employs policies that promote higher domestic Indonesian price prices in the desire to protect farmers and to reduce poverty. There is one problem with the government’s policy premise: empirical evidence fails to support it. Indeed, according to the BIES, high rice prices hurt the large majority of Indonesians – perhaps 80%.

- A detailed analysis of rice production and consumption data shows that estimates of surpluses or deficits are unreliable. Indeed, they are so unreliable that one cannot accurately determine whether there is a surplus or deficit. This is remarkable because the estimates of surpluses or deficits are precisely the basis used by the government to determine the scale of official imports.In short, the unreliability of production and consumption data simply makes bufferstock strategies and other options proposed by central planning prophets infeasible.

- If all this isn’t disturbing enough, the BIES presents evidence showing that greater parliamentary democracy in Indonesia has increased the political clout of farmers and agricultural processors. This, combined with parliamentarians’ embrace of economic nationalism, has strengthened the support for more protectionism of the rice industry.

Now that governments in the rice-consuming countries have hit the panic button, we are witnessing a stampede to introduce more interventionist measures, discredited central planning solutions and more government-to-government trade deals.

This amounts to trying to deal with the problems created by massive government- created market distortions in the rice trade by throwing in some more distortions. This will, no doubt, simply magnify our current rice problems.

Rice laws and regulations are going in the wrong direction. It takes one back to the British Corn Laws. These mandated the virtually complete government regulation of British agriculture at the start of the nineteenth century.

Fortunately, that yoke was removed in 1846. Thanks to the efforts of Richard Cobden, John Bright and the Anti-Corn Law League, the Corn Laws were repealed. This resulted in the promotion of free trade, the importation of cheap food and a major surge in British standards of living.

What rice needs today isn’t more government meddling but a modern version of the Anti-Corn Law League.

Author Steve H. Hanke

0 responses on "On Rice and Corn Laws"