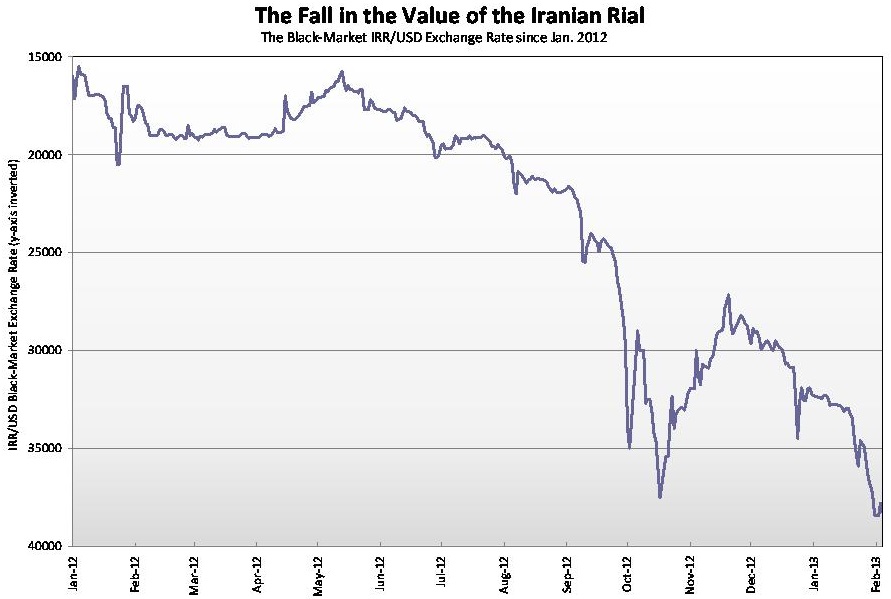

For months, I have kept careful tabs on the black-market exchange rate between the Iranian rial and the U.S. dollar. This is the metric I used to determine that Iran underwent a brief period of hyperinflation, in October 2012. And, using these data, I calculated that Iran ended 2012 with a year-end annual inflation rate of 110%.

Since the start of the new year (on the Gregorian calendar), the rial has displayed new-found weakness. Indeed, its value reached an all-time low of 38,450 rials to one dollar, on Saturday, February 2. As the accompanying chart shows, it is now trading at 38,250, moving the implied annual inflation rate to 121%, from its year-end value of 110%.

How can the IRR/USD rate be so volatile? After all, both the rial and the dollar represent nothing more than fiat currencies, without any defined value. At the end of the day, the value of a fiat currency is whatever value that fluctuations in the supply of and demand for cash balances accord to a scruffy piece of paper.

The markets for both the rial and dollar respond to conjectures about the ability of the respective governments to deliver on their stated “good” intentions. When it comes to Iran, these conjectures understandably generate sharp fluctuations in the value of the rial. Indeed, it is clear that Iranians do not trust their government to deliver economic stability. In consequence, the rial continues to tumble with increasing volatility, and inflationary pressures continue to mount.

Author Steve H. Hanke

0 responses on "Value of the Iranian Rial Hits an All Time Low"