Mexico’s presidential election isn’t until July 2006, but Mexico’s investors are already worried to the point of sleeplessness over the electoral outcome. And worry they should. Likely outcome: The winning candidate will keep in place the country’s defective monetary regime.

Even though Mexico (no less than the U.S.) has benefited from the 1994 North America Free Trade Agreement and from relative economic stability during President Vicente Fox’s administration, the country still hasn’t fully recovered from the “tequila crisis” of 1995. In the ten years since, annual gross domestic product growth has been an anemic 2.6%. This is not much above Mexico’s annual population growth of 1.5% and far below the 6% you’d expect in a country brimming with eager workers and bordering a nation that could easily supply the capital to make them productive.

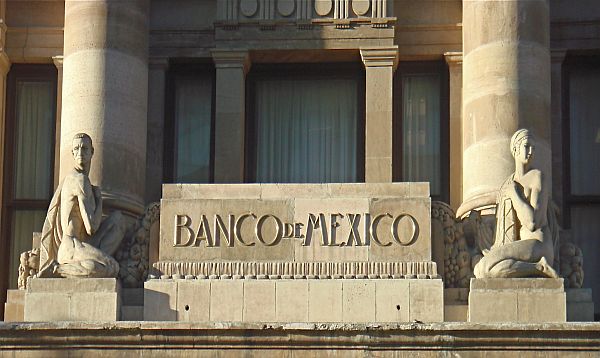

A key culprit contributing to Mexico’s malaise is its monetary regime. Following the tequila crisis the Banco de Mexico adopted Washington’s latest monetary fad: inflation targeting. Under this setup the central bank sets an inflation target (2%-4%) and manages a “floating” exchange rate.

At first glance the results of this experiment look good. Consumer price inflation has come down from 34.4% in 1996 to a tame 4.3% rate now. The interest rate on 28-day Treasury bills has fallen from 31.4% on average in 1996 to 9.6%. Mexican government bonds are now rated investment grade. The peso has avoided a meltdown in the foreign-exchange market, depreciating from 7.86 to the dollar nine years ago to 11.1 now.

Why Mexico’s feeble growth? This stems from the central bank’s manipulation of the peso. It has sterilized dollar inflows. That is, as dollars come into the country and the central bank issues new pesos in exchange, it simultaneously issues debt to soak up the peso liquidity. Accordingly, the dollars build up at the central bank, a flood of new pesos in circulation is avoided, and the peso’s exchange rate is managed. Even though the monetary base has increased to $27.8 billion today from the equivalent of $10.7 billion in 1996, net foreign reserves have increased dramatically, to $61.7 billion from $149 million.

These operations are not costless. The interest earned on foreign reserve holdings is less than the interest the central bank must pay on the bonds it issues. More important, sterilization causes interest rates and the cost of capital to rise above where they would otherwise be.

Inflation-adjusted short-term interest rates remain punishingly high at 5.3%, well above Mexico’s growth rate over the last decade.

In the face of Mexico’s malaise the peso is failing to meet the market test. Mexicans prefer greenbacks to a floating peso. In consequence the peso is rapidly losing market share. The Mexican economy continues to spontaneously dollarize. Since 1996 remittances of dollars have totaled $75 billion, while the dollar value of the peso supply has increased by only $17.1 billion.

With the peso’s importance shrinking and peso interest rates suffocating the economy, it’s time for Mexico to come clean and officially dollarize. By using $27.8 billion of its foreign exchange war chest, it could retire the peso. That would leave $33.9 billion in foreign reserves to spare. Such a package would give the Mexicans what they want: the greenback and U.S.-level interest rates. And it would promote growth.

But officially adopting a sensible monetary policy—one embraced privately by Mexicans— is probably not in the cards. This means more economic malaise.

It also means a continuation of Mexico’s labor-export policies. Apparently Mexico learned its lessons from Yugoslavia’s Marshall Tito. Tito knew that Yugoslavia couldn’t produce jobs. So he kept the Yugoslav borders open—at least by communist standards—and encouraged the export of Yugoslavia’s surplus labor. In the early 1970s there were over a million Yugoslavs, 10% of the labor force, working elsewhere in Europe. And the remittances they sent back home amounted to as much as 30% of total exports.

Rather than monetary reform, Mexican politicians have embraced Tito-inspired labor-export policies. Mexican labor regulations remain outdated and ossified—the most rigid in Latin America and even more rigid than those in France, Germany and Sweden. No surprise that 28% of the Mexican labor force is working in the U.S. Until Mexico replaces the peso with the greenback and engages in massive labor-market reforms, you can expect more Mexican malaise and more emigration.

Author Steve H. Hanke

0 responses on "Use Those Gringo Dollars"