The United States has recorded a trade deficit in each year since 1975. This is not surprising because savings in the US have been less than investment.

The trade deficit can be reduced by some combination of lower government consumption, lower private consumption or lower private domestic investment. But you wouldn’t know it from listening to the rhetoric of Washington’s politicians and special interest groups. Many of them are intent on displaying their mercantilist machismo.

This is unfortunate. A reduction of the trade deficit should not even be a primary objective of federal policy. Never mind. Washington seems to thrive on counter-productive trade “wars” that damage both the US and its trading partners.

From the early 1970s until 1995, Japan was an enemy. The mercantilists in Washington asserted that unfair Japanese trading practices caused the US trade deficit and that the US bilateral trade deficit with Japan could be reduced if the yen appreciated against the dollar.

Washington even tried to convince Tokyo that an ever-appreciating yen would be good for Japan. Unfortunately, the Japanese complied and the yen appreciated, moving from 360 to the greenback in 1971 to 80 in 1995.

In April 1995, Secretary of the Treasury Robert Rubin belatedly realized that the yen’s great appreciation was causing the Japanese economy to sink into a deflationary quagmire.

In consequence, the US stopped arm-twisting the Japanese government about the value of the yen and Secretary Rubin began to evoke his now-famous strong-dollar mantra.

But while this policy switch was welcomed, it was too late. Even today, Japan continues to suffer from the mess created by the yen’s appreciation.

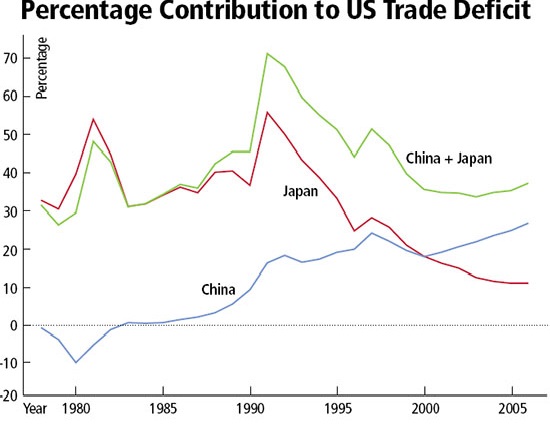

As Japan’s economy stagnated, its contribution to the increasing US trade deficit declined, falling from its 1991 peak of almost 60% to about 11% (see accompanying chart).

While Japan’s contribution declined, China’s surged from slightly more than 9% in 1990 to almost 28% last year (see accompanying table). With these trends, the Chinese yuan replaced the Japanese yen as the mercantilists’ whipping boy.

Interestingly, the combined Japanese–Chinese contribution has actually declined from its 1991 peak of over 70% to only 39% last year. This hasn’t stopped the mercantilists from claiming that the Chinese yuan is grossly undervalued, and that this creates unfair Chinese competition and a US bilateral trade deficit with China.

I was introduced to the Chinese currency controversy five years ago when I appeared as a witness before the US Senate Banking Committee on May 1, 2002. The purpose of those hearings was to determine, among other things, whether China was manipulating its exchange rate.

United States law requires the US Treasury Department, in consultation with the International Monetary Fund, to report bi-yearly as to whether countries — like China — are gaining an “unfair” competitive advantage in international trade by manipulating their currencies.

The US Treasury failed to name China a currency manipulator back in May 2002, and it hasn’t done so since then. This isn’t too surprising since the term “currency manipulation” is hard to define and, therefore, is not an operational concept that can be used for economic analysis. The US Treasury acknowledged this fact in reports to the US Congress in 2005.

But this fact has not stopped politicians and special interest groups in the United States, and elsewhere, from asserting that China manipulates the yuan.

Protectionists from both political parties in the US have threatened to impose tariffs on imported Chinese goods if Beijing does not dramatically appreciate the yuan. These protectionists even claim that China would be much better off if it allowed the yuan to become stronger vis-à-vis the US dollar.

This is not the first time US special interests have made assertions in the name of helping China. During his first term, Franklin D. Roosevelt delivered on a promise to do something to help silver producers.

Using the authority granted by the Thomas Amendment of 1933 and the Silver Purchase Act of 1934, the Roosevelt Administration bought silver. This, in addition to bullish rumors about US silver policies, helped push the price of silver up by 128% (calculated as an annual average) in the 1932-35 period.

Bizarre arguments contributed mightily to the agitation for high silver prices. One centered on China and the fact that it was on the silver standard. Silver interests asserted that higher silver prices — which would bring with them an appreciation in the yuan — would benefit the Chinese by increasing their purchasing power.

As a special committee of the US Senate reported in 1932, “silver is the measure of their wealth and purchasing power; it serves as a reserve, their bank account. This is wealth that enables such peoples to purchase our exports.”

Things didn’t work according to Washington’s scenario. As the dollar price of silver and of the yuan shot up, China was thrown into the jaws of depression and deflation. In the 1932-34 period, gross domestic product fell by 26% and wholesale prices in the capital city, Nanjing, fell by 20%.

In an attempt to secure relief from the economic hardships imposed by US silver policies, China sought modifications in the US Treasury’s silver-purchase program. But its pleas fell on deaf ears.

After many evasive replies, the Roosevelt Administration finally indicated on October 12, 1934 that it was merely carrying out a policy mandated by the US Congress.

Realizing that all hope was lost, China was forced to effectively abandon the silver standard on October 14, 1934, though an official statement was postponed until November 3, 1935. This spelled the beginning of the end for Chiang Kai-shek’s Nationalist government.

History doesn’t have to repeat itself. Foreign politicians should stop bashing the Chinese about the yuan’s exchange rate. This would allow the Chinese to focus on important currency and trade issues: making the yuan fully convertible, respecting intellectual property rights and meeting accepted health and safety standards for their exports.

0 responses on "US Mercantilist Machismo, China Replaces Japan"